- The dysfunction in the current administration is very sad to watch. Who knows how many billions Nigerian masses lost to some fat cat somewhere as a result of infighting? Nami also stated briefly that N1.8 Trillion of waivers under several arrangements, were granted in the year.

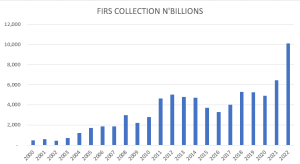

First off, our Federal Inland Revenue Service (FIRS) – soon to be known as Nigeria Revenue Service to capture the fact that revenue everywhere including online (not only inland) must be captured – must be commended on their unprecedented and superlative achievement of N10.1 Trillion collection for the year 2022. Honestly, in our country, replete with bad news, this is one news that gladdened my heart and for which I have heard or read little commentary since announced. The Muhammad Nami-led service bested itself in a performance that is also reflective of the ongoing economic recovery, after the second slump due to COVID-19 under President Buhari’s leadership since 2015. We had never neared that double digit in the trillions of Naira.

Let us do a quick rundown of our revenue performance over the years since the year 2000. In that year as the civilians settled into government, the FIRS collected a total of N455 billion across the board. By 2001, this increased to N587 billion. In 2002, collections dipped to N434 billion. But in 2003, 2004, 2005, and 2006, the numbers increased to N703 billion, N1.19 Trillion, N1.7 Trillion and N1.87 Trillion respectively, before we saw another slight dip in 2007 to N1.85 Trillion. Due to the performance of the crude oil sector, the FIRS witnessed a leap in collections in 2008 when it hauled in N2.97 Trillion. But a dip occurred in 2009, when collections slumped to N2.2 Trillion. The growth trajectory was resumed the year after and maintained for another two years when in 2010, 2011 and 2012, the FIRS collected the sums of N2.8 Trillion, N4.62 Trillion and N5.007 Trillion respectively, before another dip to N4.8 Trillion and N4.7 Trillion in 2013 and 2014 respectively. The year 2015 was a transition year, and it witnessed underperformance by the FIRS when collections slumped to N3.7 Trillion. An economic recession would follow in 2016 which further collapsed collections to N3.3 Trillion (by then the lowest collection in 7 years). Luckily, revenue collections improved the year after, when the FIRS collected N4.03 Trillion, increasing in 2018 to N5.3 Trillion, and dipping slightly to N5.26 Trillion and N4.9 Trillion in 2019 and 2020 (the COVID-19 year). Global economic recovery and resilience on the part of the service saw to an increase in collections to N6.45 Trillion in 2021 and now, a superlative performance of N10.1 Trillion in 2022. A graphical representation of the journey is presented below:

MATTERS ARISING

- Growths in collection must be discounted for inflation and devaluation.

Whereas I will commend the FIRS Chairman and his team for being focused and having ploughed through a very difficult time (COVID-19), we all must note that the growing figures must be discounted for yearly inflation and devaluation. Just as the Naira gets weaker and weaker in the hands of the common man, so also is it getting weaker in terms of the public goods it can procure for the masses. Indeed, it may be prudent to represent these numbers in dollar terms, since our economy is quite externalized and linked to the dollar. If we do this, the excitement may wane. It must however be noticed that despite inflation and devaluation, the period of 2014 to 2017 were years of decreased revenue even in absolute terms. That meant inefficiency and low value for Nigerians. This collection of N10.1 Trillion happened in a year that we didn’t have shocking devaluation – at least not officially. Therefore, it passes the test for good performance. But we must keep challenging ourselves. Rather than the political capture and executive tardiness that has held Nigeria down so far, a more articulate and focused approach could lead to significant leaps in FIRS collections. I see that figure hitting N20 Trillion soon. Customs collections, which is part of what FIRS accounts for, is impacted by Naira devaluation, and must be benchmarked appropriately so that we know when we are making real progress.

- Non-oil sector is here to stay

The Nigerian government has been very deliberate about the need for the economy to be diversified. It was however impossible to achieve this under the Obasanjo administration and it remained a struggle throughout the Yar’Adua and Jonathan administrations. We could however say this is now a reality given that we are seeing a reversal of fortunes so to speak. The oil sector used to contribute almost 65% of FIRS collections in the early 2000s. In the year 2011, non-oil contributed N1.56 Trillion as against oil sector contribution of N3.071 Trillion (almost double). 2022 performance shows that non-oil collections have now surpassed what accrues from oil. Oil sector in 2022 contributed N4.09 Trillion, while non-oil accounted for N5.96 Trillion (59%). This is good if it depicts the seriousness of our economic diversification efforts, and FIRS’s ingenuousness in going after those who should pay taxes. However, it also may belie the fact that Nigeria really lost grounds in the oil sector in 2022 and for some years now, with production dipping to somewhere below 1,000,000 barrels per day as against our OPEC quota of at least1.6 million barrels a day. Thankfully, with the contracting of Tompolo’s Tantita Security Services company, we now understand that crude oil production has ramped up considerably. With some luck, production from the Gombe/Bauchi axis may weigh in and 2023 should tell a different story, for good. We can walk and chew gum at the same time. We should be optimizing both sectors – oil and non-oil.

- Silo mentality affecting Nigeria very adversely

It must be said that silo mentality and ego trips among government functionaries was a major problem. This is more so under the Buhari administration. I wrote about that recently when the suggestion (indeed the recommendation per the 2022 Finance Act), of an introduction of 5% tax on telecommunications was stepped down ostensibly on the orders of, or with the influence of the Minister for Communications and Digital Economy. I felt this was an overkill and powerplay by Sheikh Isa Pantami and an embarrassment to Dr Zainab Ahmed who had agonized for too long about low revenues and insisted that what Nigeria has is a revenue problem more than anything else. There she was, trying to do something about it with what could be considered a good tax – easy to pay, may not be felt, and easy to collect – and being shut down summarily on national TV. This time, the FIRS Chairman could not help but express his frustration at some of what he had experienced so far, including the tendency for agencies of government to sue each other and to compete for what is beyond their remit. Hear him as quoted in Thisday Newspaper of January 24, 2023:

“We would have actually done better, but for several issues, some of which are political and very sensitive to discuss in the public domain… But the most important one is distractions from certain interests within the federal government itself and the sub-nationals or people who want to do what FIRS is doing – in other words, those that want to perform the statutory functions of FIRS of assessing, collecting, and accounting for taxes in Nigeria… These are not just mere issues but people instituting legal actions against FIRS to further distract us. People instituting, even federal agencies instituting legal actions against laws that have been passed by the National Assembly and signed into law by Mr. President…. So, these challenges impacted negatively, because you see on so many occasions people writing in to find out that ‘tax A, we are confused, we don’t know who to pay to now, that there’s a court ruling to restrict you from collecting such taxes’. So, this really impacted negatively on what we did last year… We appeal to them to continue to invest the little we are generating judiciously so that they are able to encourage taxpayers to continue to comply and pay more so that together we are able to fix Nigeria.”

I totally agree with Nami. The dysfunction in the current administration is very sad to watch. Who knows how many billions Nigerian masses lost to some fat cat somewhere as a result of infighting? Nami also stated briefly that N1.8 Trillion of waivers under several arrangements, were granted in the year.

- Waivers, concessions and forbearances need to be curbed

Flowing from 3 above, it will be good for government to have a relook at the system of waivers because this nation – with a huge debt overhang – can ill afford them. We cannot be servicing debts with over 90% of our revenue and be gifting some away at will for any reason. Personally, I think the idea of exempting companies with turnover of less than N25 million and below from all forms of taxes is preposterous and needs to be reviewed. Nigeria is an open sesame and companies are thriving here. Even if it was minimum taxation, I believe we should get. There is a strong correlation or even causation between tax responsibility and economic development. Indeed, I am proposing that we start to operate as they do in the UK and UAE (countries in which I have done business corporately). In these countries, they don’t joke with their taxes. The UAE is even introducing company income tax by June 2023. That is an Arabic country reforming. In these two countries anyway, no company can do any business or even operate a bank account in any given year except they file company returns. And the company house (like our own Corporate Affairs Commission) will not collect your returns unless you show evidence of tax payment – including remittance of your staff PAYE and National Insurance. Note that the idea of Annual Returns also has security implications as it is primarily meant to be an update of company address and director or circumstance change in a given year. This is precious data. And data is king today. Anyway, in both countries that I’ve mentioned, as it also happens in every serious country, your bank will close down your company account if you don’t supply your annual return after a deadline every year. This is what happened to Peter Obi’s Next International UK Limited. If Nigeria could effect this policy, company income tax collection will explode.

- Are Nigerians paying too much taxes already?

There’s also this argument flowing from 5 above, about whether Nigerians are already overtaxed as a result of multiple agencies and even non-state actors shaking everybody down. There was recently a short clip of a transporter of farm products in my Ondo State, who had to pay dues to about 60 agencies to do his business. There is also the popular knowledge that ‘agberos’, or those who work for transport unions around Nigeria, rake in billions of Naira daily. I want to add that I disagree though, with Messrs Taiwo Oyedele, Andrew Nevin, and others who believe that Nigerians are already overtaxed. Whereas we could define ‘taxes’ as every statutory payment that Nigerians are obliged to pay to government – including rents, rates, dues, duties, fees, levies, fines and others – I believe that it is dangerous to sell the idea to our publics that they are overtaxed already. Not many people are subjected to the multiple taxes that we complain about. And Nigerians do not pay anything near what people pay abroad. Dr Nevin argues that because Nigerians have to build their own infrastructure, we are already overtaxed. However, the idea of obligations to the state is about promoting responsible citizenship. We cannot shorty-circuit that process. Most developed countries are where they are because their citizens feel obliged to support government – to a good degree – by contributing their quotas by way of those taxes, fees, fines, duties etc., and thereby promoting collective development. Our intellectuals should try to take a long view and not discourage that larger, noble objective. The truth is that most Nigerians pay nothing. Most companies underpay taxes. Most people underpay. Even those charged with enforcement are more sympathetic with payers than being strict with their jobs. It is a fact that our governments have disappointed the people for too long with their ostentation and wrong choices. Still, we should not give up on our nation, promote the disconnection of the citizens from the country, and the eventual disintegration of our country.